Key Findings

Full Findings

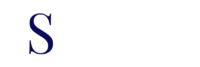

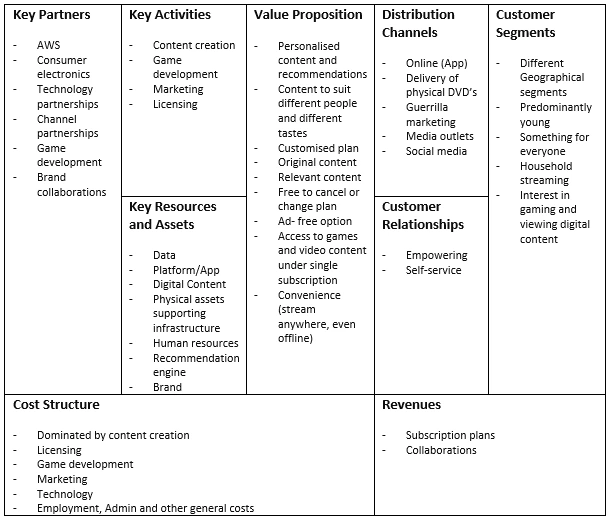

Netflix operates a subscription video on demand (SVoD) business model, implementing a value-based pricing strategy consisting of 4-tier subscription plans to extract the maximum value from different demographics. The 4 tiers are; $6.99/month for a basic subscription with ads, $9.99/month for a basic subscription, $15.49/month for a standard subscription, and $19.99/month for a premium subscription in the US, Netflix’s largest market . Between 2017 and 2022, Netflix’s revenue per subscriber has risen from $9.43 to $11.86, a 25.8% increase (Netflix, 2022k, Netflix, 2020a). Over the same time period subscription plan prices (excluding basic with ads) have risen by an average of 37.9%. Therefore, subscription prices have increased by 12.1% more than revenue per subscriber from 2017 to 2022, indicating an increasing propensity over time for Netflix members to favour lower price plans at the expense of quality. Overall, revenue for Netflix has grown consistently between 2017 and 2021, increasing from $11.69 billion in 2017 to $29.7 billion in 2021, representing a year-on-year average growth rate of 38.5%.

Netflix’s tiered subscription options grant personalisation autonomy to consumers dependent upon their individual indifference curves and their perceived weighting of price versus utility. By introducing a variety of subscription tiers, Netflix has improved its ability to penetrate lower income demographics without sacrificing the ability to capture value from other target demographics. In 2022, Netflix saw its first drop in subscriptions, which led to it responding by introducing the basic with ads subscription tier as a remedy. Considering the trend in Netflix’s user base to favour lower prices over quality, this move is logical as it introduces a revenue stream from targeting verge consumers who marginally assess the basic subscription content to not justify the price whilst simultaneously generating ad revenue to mitigate lower margins.

However, one issue of particular plight to Netflix’s revenue is the problem of password sharing. Netflix estimates that 100 million households have access to Netflix using another households subscription. This haemorrhages revenue from Netflix. Resultantly, Netflix is contemplating introducing a ‘paid sharing’ option in the future so that individuals from other households can make use of a households Netflix subscription, opening up an additional revenue stream for Netflix.

Netflix is available in over 190 countries worldwide

The core aspects of Netflix’s cost structure are research and development costs, content creation costs, general operation and administration costs, salary and other employment costs, Infrastructure and platform maintenance costs, and Marketing costs. Of these costs, Netflix’s cost structure is dominated by content creation costs, with content creation costs exceeding costs of revenue from 2017 to 2019, only dropping below for 2020 and 2021 due to the COVID-19 Pandemic. This indicates that Netflix is spending more money in some years on creating new content to maintain its pipeline than the total cost of all the revenue it generates in the same year. By comparison of its competitors, Netflix also spends vastly more money on creating original content, with a higher spend on original content in every year from 2017 to 2021 than Hulu, Amazon Prime video and Apple TV+ combined. Netflix’s exceptionally high expenditure on original content is a core component of its business model, creating substantial unique value through new digital experiences, helping it rise to dominance within the SVoD Market.

The year-on-year rate of change in content creation costs has fluctuated sporadically between 2017 and 2021, averaging a 21.52% increase yearly, rising from $8.91 billion in 2017 to $17 billion in 2021. By comparison, Netflix had revenues amounting to $11.693 Billion in 2017 rising to $29.515 Billion in 2021. However, the rate of change year-on-year for Netflix’s streaming revenues is constantly diminishing since 2017 as indicated by the transition from a 37% increase between 2017 and 2018 to a 19% increase between 2020 and 2021. Therefore, the ability of Netflix to improve revenue through creating new content is heavily dictated by production costs, internally constraining Netflix. To be specific, the costs of content creation must be justified by their propensity to provide additional revenue and profits, hence Netflix is constrained by the diminishing marginal utility of content production for generating additional revenue. Considering that Netflix cannot be certain how its content is received, it cannot guarantee these revenues from its content creation costs.

To finance the production of new content outside of retained profits, Netflix relies heavily on debt financing, specifically corporate bonds. As of the end of Q1 2021, Netflix had $15.6 billion in senior unsecured bonds outstanding, with total debt financing growing by 25% from the previous year but tapering off over the next two years down to $13.9 Billion by Q3 of 2022. Of key concern for issuing corporate debt to finance content creation is the unpredictable nature of how the content will be received. Improvements in AI and ML allow Netflix to better capture peoples preferences and produce more successful content, which paired with vast content creation have allowed Netflix to steadily grow revenues. But the existence of unsuccessful content launches and diminishing revenue growth over time will still make debt financing more risky and less attractive to holders. Facing the internal constraint of the cost of producing new content, Netflix must focus on the scalability of its features and offerings with respect to creating additional revenue moving forward.

Netflix produces substantially more original content than any other company in the SVoD market

The first step in Netflix improving its scalability capabilities is developing on a platform that can handle rapid changes/growth in users, in different operational geographies seamlessly. To this end, Netflix has partnered AWS to host its platform and take care of its storage needs, databases, data analytics, recommendation engines, video transcoding and other functions. With a platform setup to allow Netflix to scale its operations, the next hurdle in improving scalability is overcoming Netflix’s Internal constraint of diminishing returns to content creation in generating revenue.

To overcome its diminishing returns and provide incentive for people to subscribe to Netflix, it has begun branching out into game development, incorporating this additional offering under its pre-existing subscription plans to bolster the value provided and further scale up its operations. Branching out into game development seems like a logical step for Netflix, given that the gaming industry raked in $134 billion in 2020 compared to $71 billion for video streaming content in the same year. In addition, Global distribution of time spent on video games by age demographic is reasonably similar across ages, indicating that Netflix can scale its operations by targeting older demographics which it hasn’t currently penetrated as much as younger demographics.

One key disadvantage that Netflix has against some of its competitors is its current lack of additional offerings with its subscription plans. Taking key competitor Amazon with its prime video for example, with a prime membership you can access video streaming content, music streaming, prime reading, one-day delivery and discounts on Amazons E-commerce site, unlimited photo storage and many other benefits. Competition within the market is choking Netflix’s ability to grow and externally constraining it, with competitors offering many additional benefits to owning a subscription with them. Therefore, if Netflix manages to successfully develop its gaming service and/or continues to offer additional subscription benefits moving froward, it will allow Netflix to remain competitive and continue to grow.

Netflix Business Model Canvas

To better capture future revenue streams, particularly given the context of current geopolitical and global economic conditions, Netflix will have to get creative. One key strategy would be to increase its focus on less heavily saturated markets such as Asia-Pacific markets. Netflix’s existing AI and ML infrastructure paired with its substantial capital will facilitate significant and nuanced research into successful entry strategies. When formulating an overarching strategy and selecting where to penetrate, market saturation, disposable income, economic conditions, user preferences, cultural differences, and available infrastructure should be careful considerations. The best option for Netflix would be to trial various services and bundles in less penetrated markets and utilise its robust internal research and review infrastructure to assess the success of said trial(s) against key metrics, thus narrowing down viable candidates and improving the probability of successful market penetration. By methodically reviewing and analysing markets in this way, in tandem with expanding their offerings and bundles, Netflix will have more flexibility in what it can offer and where, creating additional value through enhancing personalisation and personability, adding to its profitability.