Key Findings

PR Management Market Mapping

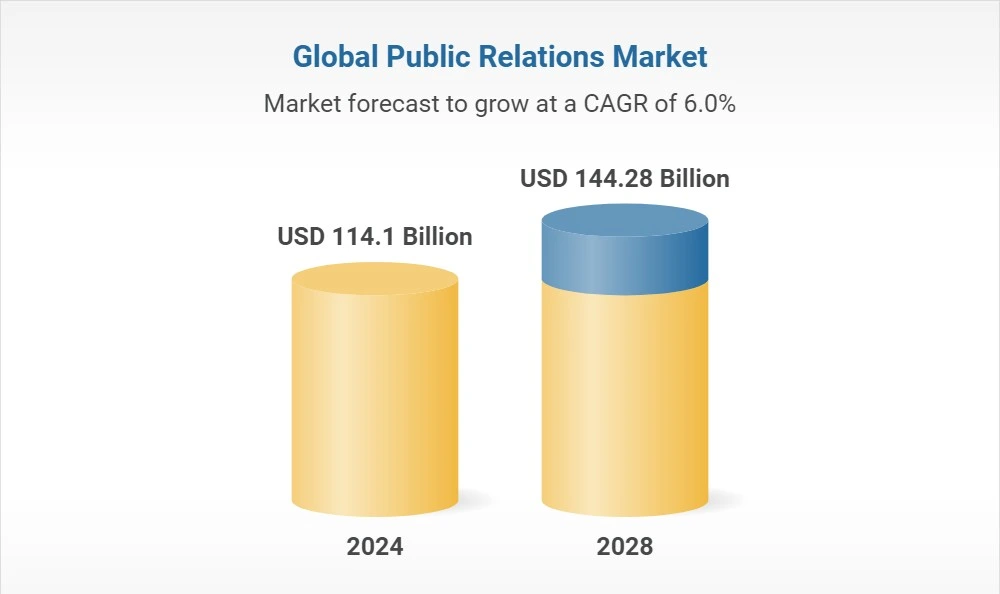

The global PR market has seen a steady increase in size from 15 to 19.5 billion dollars between the years 2018 – 2023, representing a 30% increase. However, market size dropped in both the 2019-2020 and 2022-2023 periods, indicative of a potential stall in growth. The initial dip coincides with COVID-19 and the subsequent economic slowdown, however the latter dip does not coincide with a specific significant economic event and hence cannot be as easily attributed to unfavourable economic conditions. Other estimates encompassing a broader definition of what constitutes the global PR market place its current size at as high as $114.1bn as of 2024. The global PR Market is expected to grow at a compound average growth rate (CAGR) of 6%, increasing in size to $144.28bn by 2028.

The highest growth experienced by PR companies globally in 2023 were obtained by Spanish-based Apple Tree and its subsidiary keeper experience (90%), UK based The Romans (89.9%), and US based Avoq (85.1%). Meanwhile, the largest PR companies globally listed by revenue are Edelman ($892m), Weber Shandwick ($865m), BCW ($740m), FleishmanHillard ($605m) and Ketchum ($535m). Looking at UK based companies only, the 3 largest companies are Brunswick ($324m), Teneo Holdings ($145m), and Freuds ($69m). Within the UK PR market, the largest segments by revenue are external reputation management, branding and marketing, and communication services. The market composition is largely monopolistically competitive, with many smaller companies dominating the landscape, as opposed to fewer, larger companies. Monopolistically competitive markets tend to have fewer barriers to entry and as such are easier for start-up businesses to gain a foothold in.

When launching a start-up it is often advised to seek comparably newer, less saturated, and particularly high-growth market segments, unless a particular need in older, more stagnant, more saturated markets is identified as being underserved. The relative newness and/or substantial growth of markets can help prevent suffocation by over saturation and can promote small businesses to grow alongside the market to see substantial gains if they have a suitable value proposition. Analysing the market composition through this lens, over the period between 2024 and 2030, social media management is the segment of the PR market expected to see the highest growth rate, with an expected compound annual growth rate of 14.1%. Specifically, content creation is the subsection expected to see the highest compound annual growth rate over the period, with a figure of 18.4% year on year. Relating to sectors, the consumer and retail goods sector is currently expected to be the most lucrative and is the prime focus of many PR management companies, although numerical estimations are scarce. Furthermore, north America was seen to be the largest market for PR management, with a share of 33.6%, closely followed by Europe and the Asia-Pacific region.

The full breakdown of PR management companies by type is as follows: 1) Investor relations, 2) Social media, 3) Content creation, 3) Public affairs, 4) Crisis management, 5) Corporate communication, 6) Media relation, 7) Event management, 8) Other smaller segments. Regarding market composition by end-use, the breakdown of the most common types is as follows: 1) BFSI. 2) Retail and consumer goods, 3) Business and consumer services, 4) Healthcare, 5) Manufacturing, 6) Transportation and mobility, 7) Energy and utility, 8) Media and entertainment, 9) Hospitality, 10) Other smaller segments

The global PR Market is expected to grow significantly over the next 4 years

Macro industry trends within the PR industry include AI and automation, ethical branding, increasingly data driven storytelling, more personalised and humanised PR approaches, and heavier focus on streamlining social media communication.

AI & Automation – A survey conducted by Prowly found that respondents rated AI content creation (36%) as the top trend within the PR industry, followed by data driven PR (17.5%), and AI for conducting research (12.9%). Cumulatively therefore, nearly half of all responses (48.9%) rated AI as the key industry trend of 2024 within the PR sector. Their report identifies that AI can be used to improve insights and understanding of key issues, facilitating the production of better-quality PR content. Furthermore, AI can be used to generate digital images and commentary for the purpose of branding and marketing. However, it should also be considered that given the current high levels of awareness of using AI for image and text production, the marketability of said to many technologically savvy companies is somewhat diminished. However, deductively the opportunity for marketability of such a service significantly increases for smaller businesses who have less technological knowledge and capacity. Prowly’s study also highlighted that AI can increasingly be used to spot patterns within surveys and documents, as well as summarising key trends to produce better quality PR materials. Historically, effective qualitative data summarisation from large data sets would require enlisting the help of a specialist, either internally or externally. However, AI facilitates the streamlining of this process, resulting in reduced costs and a comparative advantage over PR companies that still rely upon traditional methods.

Ethical PR – A recent Harvard Business Review survey found that Gen Z and Millennials are 27% more likely than older generations to support brands that prioritize their social and environmental impact. They are also 15% more likely to choose brands with strong ratings for humanity, and 30% more likely to spend more on brands recognized for their transparency. This trend of ethical purchasing creates a parallel growth opportunity in the PR sector as increased impetus is placed upon ethical branding, in particular for companies that target younger audiences. Therefore, an implied market opportunity is to provide ethical PR services to environmentally and social conscientious enterprises.

Data Driven PR & A Personalised Approach – Of the 300 PR professionals Prowly surveyed, data-driven PR was agreed upon as the second biggest industry trend. Specifically, an increased importance is being placed upon utilising big data (database records, web traffic, customer feedback etc.) to better understand target audiences and derivatively better target PR material. This has implications for PR start-ups, because many SMB’s may not have the tools or skillset to understand and organise large data sets for the purpose of tailoring PR, creating a market opportunity. A 2021 Survey by Muck Rack found that journalists increasingly favour shorter PR pitches, under 200 words, emphasising quality over quantity . This coincides with Prowly’s 2024 survey findings that 14.2% of PR professionals who responded said that mass media pitching’s should be a thing of the past. The move to more personalised PR writing coincides with industry opinion that a more humanised approach, focusing heavily on sufficient feedback systems and two-way communication are key to promoting a stronger impact. To summarise, these trends highlight the need for greater engagement with data and feedback from both companies and their customers to drive and inform PR decisions and create value for PR companies.

Streamlining Social Media Communications – A growing trend within the PR industry and more generally society, is the use of short form videos on social media. Specifically, social media platforms like TikTok, Instagram, and Facebook, as well as video sharing sites like YouTube, have seen a marked increase in the use of short form videos for brand PR purposes. This creates two key marketable opportunities. Firstly, PR companies that can use data to improve and streamline how companies advertise their brand and spread information stand to gain custom as increased reliance is placed on short form videos for marketing. Secondly, PR companies that can develop a network and connect businesses with the correct influencers/personalities for their products are increasingly likely to generate business as the trend develops.

AI and Automation is the most important current trend critical to success for a PR company

Industry Leaders within the PR sector largely provided a broad variety of PR services and generated revenue for many streams, an approach which is not initially viable as a small PR start-up. However, analysing the industry leaders, particularly those that have experienced the largest growth in 2023, gives key insights and lessons into how success can be attained within the market.

Apple Tree – Apple Tree CEO Carme Miro largely attributes its success to results driven PR, putting significant emphasis on creativity, saying many of the best PR campaigns have been creative highly creative. This ties into industry trends identified that suggest an increased importance on data-driven PR campaigns and more personalised approaches to PR, with implications also for the nature of social media campaigns and the importance of creative and targeted content.

The Romans – Although significantly smaller than Apple Tree, The Romans has seen substantial growth within its short existence since 2015. The Romans also attributes its growth largely to creative PR and “treating every brief and pitch like its going to result in our finest piece of work ever”. Furthermore, they also highlight the importance of culture and staff morale in promoting high-quality deliverables, as well as hiring exceptionally talented staff. Echoing the importance of creative content further entrenches previous findings that the key to substantial growth is in the level of creativity offered, facilitating a PR company to stand-out from the crowd.

Avoq – Avoq was formed in 2023 as the result of a merger. The merger brought together several PR companies each bringing their own expertise and experience to create value for the company. Avoq attributes its success particularly to finding its clients target audience and using a data driven approach to find how to best engage them. It is unique from the other highest growth companies of last year in that it doesn’t put specific emphasis on creativity being essential for success, but instead on having the best information possible and a network of specialists. This approach may not be competitively viable for a smaller start-up such as your business, however within the context of an industry trend increasingly relying on AI for data analytics and data gathering, Avoq’s approach highlights the potential importance of such tools for smaller PR companies to grow their business.

Creative outputs have been the key to unlocking high growth for many companies

As of 2021, the size of the global web development market reached $56 billion, with the expectation that this figure could more than double to $131 billion by 2032, indicating significant growth potential within the market. Specifically, UK market size was estimated to be at £623.1m with a 62.6% growth in demand for web development since 2020. The UK market was additionally estimated to consist of 2,041 web design agencies as of the end of 2023.

The market type is largely monopolistically competitive with elements of oligopoly present, however one firm in particular presents potential monopoly power, Wix, an Israel based website building company with a 43% market share. Other key players include Squarespace (22.4% share), Weebly (9.9% share), and Blogger (6.6% share). The largest UK web design companies as of 2024 were Angry Creative (UK) Ltd. (£6.7m revenue (1% market share)), WebFX EMEA Ltd. (£2.9m revenue (0.5% market share), and Cyber-Duck Ltd. (£2.4m revenue (0.4% market share)) . The UK market for web design therefore is demonstrably more monopolistically competitive, with many sellers that sell a similar but differentiated product, with global website building markets being more oligopolistic with a few large players. A key distinction between the two however is the implied broadness of web design companies compared to the more specific niche of website building companies, where the former market is highly saturated by larger companies and may be more difficult to compete in for a start-up due to its oligopolistic nature. Conversely, monopolistically competitive markets have relatively low barriers to entry and are ideal for start-ups to produce a similar but slightly differentiated product/service to gain custom.

Regarding web design market composition and growth by geography, the North American market is both the largest and expected to grow by the most significant amount over the 2020’s, with 40% of the global market share and an expected compound annual growth rate (CAGR) of 6.7% between 2024 and 2031. The UK market sits at just 4% of the global web design market share as of 2024, however its expected compound average growth rate (CAGR) is one of the highest globally, expected to be 7.8% between 2024 and 2031. Asia-pacific markets however are expected to see the largest CAGR between 2024 and 2031, with CAGR expected to be 10.5% and current market share sitting at 10.5% as of 2024. The largest segments in the web design space by market share are single page web design and flat web design, making up over two thirds (68%) of the web design market. However, both the single page web design and flat web design segments are considerably saturated, meaning that whilst their size presents large profitability potential for the successful start-up, getting a foothold initially may be challenging. Meanwhile, the highest growth market segments in the web design industry are considerably more niche and less saturated, with them being illustrative web design and typography web design. Because typography and illustrative web design are comparably tiny markets with high growth rates, lower competition and market growth could promise significant returns, but their current small size may also make it harder to find customers and establish a solid clientele.

Large enterprises, often run by private companies, heavily rely on web design services for their operations. Though fewer in number compared to SMEs, these companies account for a significant share of the market. To handle their high levels of online traffic, they frequently opt for premium and highly secure web design solutions, such as dedicated hosting. Additionally, many e-commerce websites choose dedicated hosting services to bolster the security of their platforms. Despite the largest market share being dominated by large enterprises, the fastest growing market segment by customer is web services for SMEs, representing the ideal conditions for growing a start-up within the space as larger enterprises are likely to go with more established web design companies that offer more robust services.

Website building services are better for start-ups, given the oligopoly/monopoly present in web design companies

Regarding current trends, several considerations for how value creation can be maximised in the current web design climate emerge. These are 1) typography and text-based design, 2) interactivity & user engagement, 3) illustrations, animation and visual layering, 4) minimalism and brutalist design, 5) geometric and organic design, 6) visual effects & enhanced display, 7) enhanced user experience & strategy, and 8) advanced technology & immersive experiences.

Typography & Text Based Design – Typography and text-based design are evolving to make a stronger visual impact. Kinetic typography and structured typography emphasize readability and motion, creating dynamic, engaging text elements. Designers are experimenting with the orientation of text, such as mixing horizontal and vertical placements, as well as using bold, text-only hero images that forgo heavy visuals in favour of direct communication. Playful fonts like sans serif typography and retro-inspired minimal vintage fonts add personality to a brand’s identity, blending past and present aesthetics.

Interactivity & User Engagement – Interactivity is at the heart of modern web design, enhancing user engagement through responsive and dynamic features. Drag interaction, scrolling animations, and dynamic cursors allow users to interact with websites in more personalized ways. Micro-interactions and micro-animations offer subtle feedback to user actions, while gamified design and interactive 3D models create more immersive, playful experiences. Voice-activated interfaces and conversational AI, such as advanced chatbots, make user interaction more accessible and efficient, blurring the lines between human and digital communication.

Illustrations, Animation & Visual Layering – Illustrations and animations are key to making websites stand out. Animated illustrations, custom illustrations, and isometric designs add a unique, artistic layer to storytelling. Layering of different visual elements, along with blending photos with graphical elements and incorporating 3D design, adds depth and dimension, making designs feel more dynamic. New visual aesthetics such as claymorphism, art deco, and scrapbook styles are also gaining popularity, each offering distinct stylistic approaches ranging from playful to vintage sophistication.

Minimalist & Brutalist Design – Minimalism continues to be a powerful trend in web design. Ultra-minimalism and text-only designs focus on simplicity, removing unnecessary elements to create clean, functional layouts. On the opposite end of the spectrum, brutalism embraces raw, bold design choices, showcasing unrefined yet striking visual elements that stand out for their simplicity and directness.

Geometric & Organic Design – Designers are increasingly balancing geometric precision with organic forms to create more harmonious layouts. Geometric shapes and patterns, organic shapes, and the use of grid lines provide a structured yet fluid approach to design. Broken grids and visual layering break from traditional layouts, leading to more experimental and innovative designs.

Visual Effects & Enhanced Display – Visual effects and enhanced display features are becoming standard in modern web design. Cinemagraphs and smart video content combine subtle motion with traditional images, delivering a dynamic yet lightweight experience. Frosted glass effects, full-page headers, and full-height homepage heroes create an immersive visual experience, while dark mode offers a sleek, eye-friendly alternative. For those looking to tap into nostalgia, Y2K-inspired designs bring a futuristic retro aesthetic to modern websites.

Enhanced User Experience & Strategy – A strong emphasis on user experience and conversion strategy continues to guide design decisions. Clear, accessible designs ensure that user navigation is intuitive, while elements like lead nurturing forms integrated with CRM tools help streamline data collection and conversion. High-quality product photography is also a major focus in e-commerce, making products the center of attention. Data visualization tools allow for the presentation of complex information in visually engaging formats that users can easily understand.

Advanced Technology & Immersive Experiences – Advanced technology is reshaping the possibilities of web design. Virtual reality provides immersive digital experiences, and material design adds a tactile, realistic feel to digital interfaces. As these trends continue to develop, the boundaries between user interaction, technology, and design are becoming increasingly seamless, creating more engaging, intuitive, and visually appealing digital experiences.

Utilising key industry trends will help maximise value creation and growth

Angry Creative Ltd. Started creating value for it’s clients by providing more cost-effective solutions for corporate clients than existing publishers, illustrating an entry strategy of affordable quality to substantiate a growth in market share. They started utilising the WordPress platform, as the most popular platform of its type for web development. However, their business growth strategy that enabled their continued growth was one of longer-term vision than other competitors within the space at the time. Specifically, they focused heavily on positive client relations and developing a robust business infrastructure to facilitate long-term value delivery with the aim of maintaining higher quality than their competitors for many years. This highlights their clear strategy to pursue differentiation leadership, by producing higher quality and/or more personalised services than competitors. Another prong in their strategy was to host industry events, namely Wordcamp, providing an ideal networking opportunity whilst establishing their name amongst other industry leaders. As the business grew, other revenue streams were explored, including vertical integration into web hosting and the launching of their own product lines, evolving beyond just a service providing business. The success of Angry Creative Ltd. therefore can be summarised as having a clear entrance strategy that provides similar quality at a more affordable price to competitors, and initial expansion through solidifying bonds and strong stakeholder management practices. This success story highlights the importance of networking, client relations, and differentiation in translating Elyrium from a start-up to a successful enterprise.

Connections and quality helped set Angry Creative on the path to success